Presented by Cello Health BioConsulting, now part of Lumanity

Moderator:

- Michael C. Rice, MS, MBA, Principal, Head of Advanced Therapeutics

Panelists:

- James Hamilton, MD, MBA, Vice President, Head of Clinical Development, Arrowhead Pharmaceuticals

- William S. Marshall, PhD, President, CEO, miRagen Therapeutics, Inc

- Barry S. Ticho, MD, PhD, FACC, Chief Medical Officer, Stoke Therapeutics

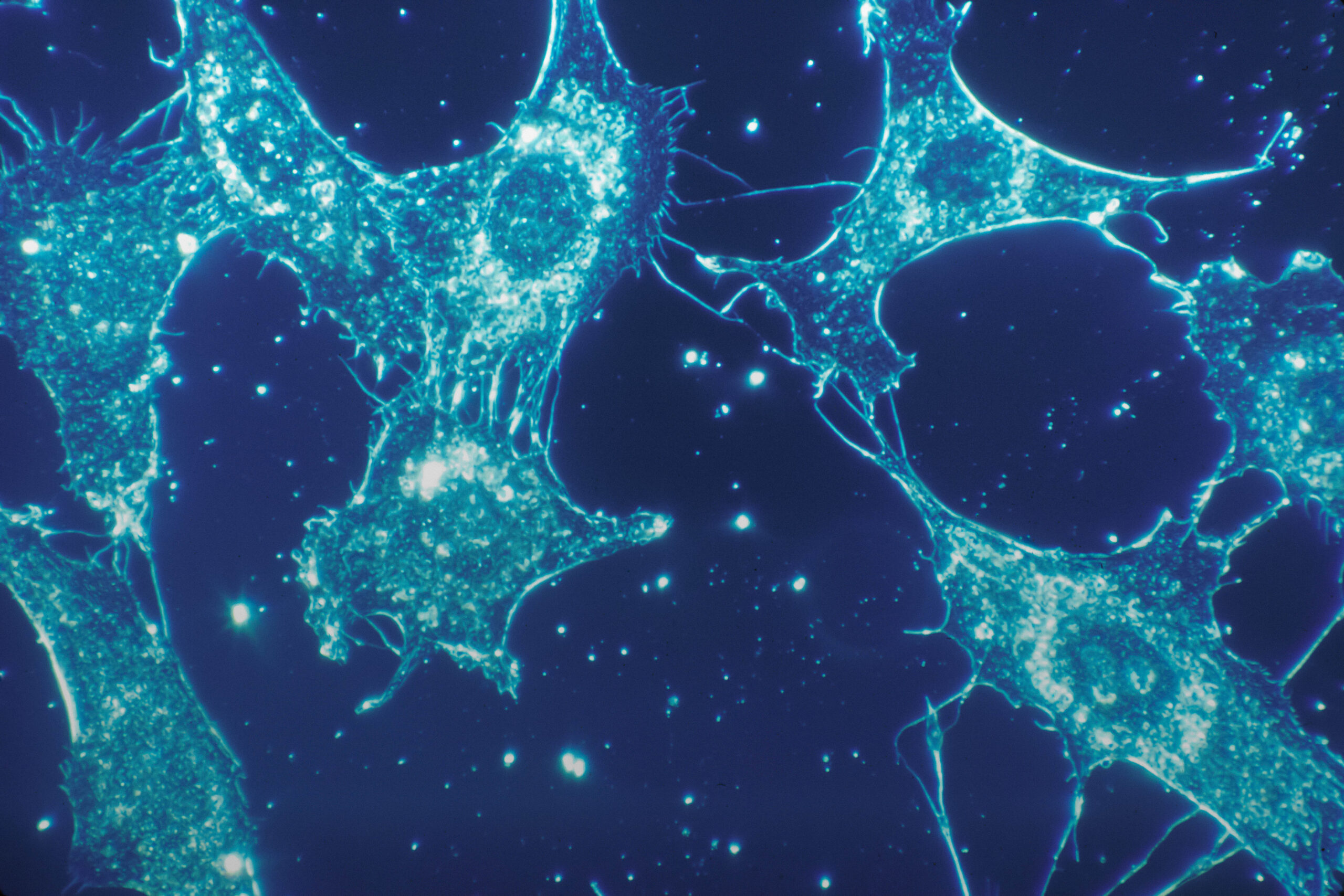

Over the past several years, small biotech has taking the lead on driving on significant progress in the development and clinical validation of nucleic acid therapeutics (NAT) across a range of therapeutic areas, largely for rare disorders, such as:

- Ionis’ Kynamro (homozygous familial hypercholesterolemia)

- Sarepta’s Exondys 51/Vyondys 53 (Duchenne muscular dystrophy)

- Biogen’s Spinraza (spinal muscular atrophy)

- Alnylam’s Onpattro (hTTR amyloidosis polyneuropathy)

- Alnylam’s Givlaari (acute hepatic porphyria)

All the approved approaches utilize synthetic oligonucleotides but employ different chemistries, delivery vehicles and therapeutic mechanisms: messenger RNA (mRNA) degradation using RNAse H dependent antisense oligonucleotides (ASOs) and small interfering RNA (siRNA) technologies which activate degradation by the RNA-Induced Silencing Complex (RISC). Furthermore, mRNA up-regulation approaches such as Exon Skipping ASOs and mRNA Splice Modifiers have led to breakthrough therapies. Beyond these approaches, earlier in development include other inhibitory RNAs and technologies with the ability to augment mRNA leading to upregulated gene expression, improve mRNA trafficking and correct codon reading frames or enhance their translation into functioning therapeutic proteins.

Initially, large biopharma tested the waters by establishing POC in rare and niche settings, whereas more recent interest has been intensely focused on validation of NAT platforms within broader diseases like hepatitis B, hypercholesterolemia and secondary CVD prevention. In response to these clinical wins, and with the anticipation of additional approvals on the horizon, there has been a flurry of deal activity, with each of the Alnylam/Regeneron, Arrowhead/J&J, Dicerna/Roche and Dicerna/Novo Nordisk deals having the potential to top $1B apiece. Biotechs with NAT drugs in their portfolios have generally seen an increase in shareholder value and lucrative exits such as the watershed $9.7 billion acquisition of The Medicine’s Company by Novartis for inclisiran, a GalNAc-conjugated siRNA against PCSK9 licensed from Alnylam. While inclisiran faces intense competition being a late entrant into the cholesterol market, it is anticipated significant market share can be captured due to its robust therapeutic index equal to or superior to PCSK9 antibodies (Repatha and Praluent) and with a “vaccine-like” administration schedule and value-based price contracting. Beyond these successes, however, significant challenges remain. Improving therapeutic indices across novel targets and diseases, and addressing insufficient delivery to affected tissues remain as major barriers to the development and commercialization of NAT drugs.

Join our distinguished panel of nucleic acid therapeutic experts as we discuss the technology behind these innovative platforms, how to navigate the remaining scientific, clinical & commercial challenges, and what upcoming value-inflecting events can be expected.